Meta: Due diligence in biotech equity investments

Case studies from the Mythos Biotechnology Fund

Note: I designed this logo for Mythos!

I was recently a partner in the Mythos Biotechnology Fund, which is an investment club focused on publicly-traded biotechnology equities. Partners meet monthly to discuss ongoing clinical trials and collectively make trading decisions in an investment pool. As part of the education efforts, I organized an analyst training program for new partners and community members. Some of our investment pitches have been recreated as reference material for this program. This article shares these case studies as examples for conducting biotech due diligence.

Evaluating biotechnology companies

Evaluation of investment opportunities is nontrivial, and especially challenging for companies developing drugs. This is because biotechnology is an esoteric discipline and to understand it requires considerable expertise. A rigorous assessment of a biotech stock involves studying the basic science, preclinical data, clinical trial design, financial positions, and management team. The collective information will help inform what the probability of success is to develop a safe and efficacious drug and simultaneously generate blockbuster sales. Here are a few questions to address within each category:

Basic science - What is the underlying technology and what are the assets derived from that? How should this drug candidate interact with the biological pathway? How well understood is the mechanism of action? Have others pursued targeted therapies in a similar manner? What are the potential undesirable effects of modulating this target?

Preclinical data - Is the drug candidate potent in both in vitro and in vivo experiments? How well does the cell culture or animal model represent the disease? Are the pharmacokinetics and pharmacodynamics of the drug candidate as expected? What experiments are missing and should be done? How does the data of this drug candidate stack up against data of other molecules?

Clinical trial design - What is the lead indication and what is the standard of care? How are patients being selected? What are the primary and secondary endpoints and are these chosen correctly? Are there biomarkers that could help guide therapy? Is the design different from others investigating similar indications? What is the regulatory process like?

Financial positions - What is the market capitalization (or enterprise value) and is this fair? What is their cash position and burn rate? Is there sufficient capitalization to reach milestones and inflection points? When will the company need to raise (and therefore dilute shareholders)? Who are the major investors and what are their positions like? Who are the directors and what is their stake in the company? What is the patent portfolio and how long is its lifespan?

Management team - Who is leading the company and what is their experience like? What are their likely connections? Are they transparent with progress and expected readouts? Do they complete milestones consistently, or do they tend to overpromise and underdeliver?

These are but a subset of questions to address during due diligence. Answer as many questions as possible to be thorough and confident in your investment.

Selected case studies on biotech stocks

I’ll highlight two case studies produced from the Mythos Biotechnology Fund. Note, these case studies are not investment recommendations; the sole purpose is to serve as training material for the fund’s investment analysts and those new to biotech investing.

Aravive ($ARAV) case study - I worked with Mike Van in developing an investment pitch for long $ARAV. Aravive is a single-asset spinout from Stanford University. Aravive is developing an AXL receptor decoy to sequester GAS6 ligand, thereby suppressing the AXL/GAS6 signaling axis. This drug in combination with chemotherapy could be a successful treatment for patients with platinum-resistant ovarian cancer, as well as those with fibrotic diseases.

Source: Aravive corporate presentation

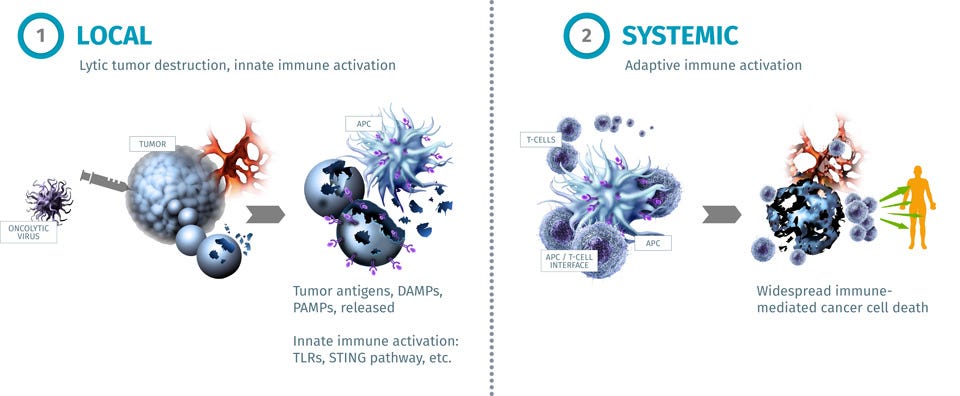

Replimune ($REPL) case study - Mike Van, Naomi Pacalin, and Bryan Xie created an investment pitch for long $REPL. I helped advise the team during the due diligence process. Replimune is developing engineered herpes simplex virus to stimulate local and systemic immune response against cancers. The combination of these oncolytic viruses with checkpoint blockade has considerable promise for treating patients with refractory cancers.

Source: Replimune corporate presentation

At the time of investment, both of these companies were in early stage clinical trials. Clinical data was limited, so a significant part of the due diligence was centered on the basic science and preclinical data. We quickly acquired a comprehensive understanding of the technology, disease biology, and what competitors were doing. However, the financial position (e.g. low and unfair valuation; decent cash reservoirs) and upcoming clinical readouts were instrumental to the investment recommendation. Fortunately, these investments panned out. This is not always the case, however, given the volatile and unpredictable nature of biotech equities. Thorough due diligence helps to mitigate the risk and properly estimate the probability of success.

Author information

Ergo Bio closely follows innovation in the biotechnology space and evaluates interesting drugs and deals. It is run by Vandon T Duong (LinkedIn), feel free to connect! I am a biotech enthusiast and a molecular engineer by training. I am also an avid consumer of news and research around precision medicine.

Ergo Bio pages

Disclaimer

This article serves informational purposes only and should be treated strictly as educational material, not as investment recommendation or legal advice. The information presented may be inaccurate or out-of-date. The contributing authors and editors disclaim liability for any errors or omissions. Any opinions expressed may change without notice. Ergo Bio LLC reserves all rights to the content generated through this resource hub (Ergo Bio Insights).